Looking forward to a New Year on the retail high street in 2019

Richard Loh, CEO of Eurostop reviews 2018, and gives his thoughts on the retail high street in the year ahead. A look back at 2018 [th-slider design=”design-2″ dots=”false” arrows=”true” autoplay=”true” limit=”-1″ autoplay_interval=”5000″] It has definitely been a challenging period everywhere, including on the retail high street. Eurostop is approaching its 30th Anniversary and I am pleased to say that despite the challenges of 2017 and the following uncertainty with Brexit, we will be posting record profits for the retail year 2018. Last year was an interesting period for Eurostop, with growth across the board – from retail system and EPOS rollouts to releases of exciting new retail technology, and reaching new areas of the globe collecting tenant sales in some mega shopping malls. Many of our retailers have been with us for years and continue to grow as they expand into new markets, embracing changing consumer habits. There have been winners and losers, and the sad news of the difficulties of some notable retailers makes it an achievement to be standing strong on the British high street with our retail partners. The retail high street does indeed continue on, with astonishing advancements in technology. Working smarter, with smart technology means that you can ultimately make savings across your retail business. Having robust software to make sure that you have the right products and stock in the right place ensures that your customers can get what they want, in the most frictionless way possible for them. On the high street, new technology is being used everywhere from the stock room, to the shop floor. In store, online is not a competitor, but a way to enhance the experience and service in store, as we move closer towards that Customer Centric ethos. Of course providing true customer convenience means that hopefully your customers will be happy to share their data in return for this enhanced personalised service, and the GDPR won’t be a barrier to collecting their data. February will bring The Year of the Earth Pig in the Chinese lunar calendar and 2019 is said to be an auspicious year. I certainly wish you all happiness and prosperity and to establish some new relationships with many of you in 2019.

Digital Payments and the Retailer

The pros and cons of using digital payments-only. Some retail outlets are experimenting with moving to digital payment-only operations. As non-cash payments become the norm, some retailers, particularly in hospitality, no longer accept cash. While there are downsides to managing cash, what are the pitfalls of refusing to deal with it? Mark McMurtrie, Independent Payments Specialist, and I outline the benefits and the disadvantages. Cards have long dominated retail spending by value but according to the British Retail Consortium (BRC), they now also account for over half of all retail transactions too. Figures published by the BRC state that debit cards account for 42.6% of all transactions, whereas cash is 42.3%. According to UK Finance 77% of all UK retail spending was made by cards. This trend has been driven by the widespread adoption of contactless and other forms of digital payments, which have finally won over the British public. Both the London Business School and the Bank of England have suggested that contactless cards are fueling spending. It is less psychologically painful to pay for an item with a contactless card than it is to part with cash. Card payments now account for over half of all retail transactions Digital payments are evolving fast Ten years ago the payments industry was dominated by about 10 companies (banks, Visa, Mastercard etc.), now the payments landscape has changed vastly and we are looking at more like 500 companies providing payment services to merchants. While some of the payment services now on offer are highly specialised, overall the choice for the consumer has increased tremendously, and raised expectations through the roof. Consumers now expect fast and secure payments, no risk, and, no charges. This is driving down costs, increasing competition and squeezing margins for the acquirers (typically banks), most of which is good for retailers. This new payments landscape has been driven by e- and m-commerce, of which most retailers have been a part. PayPal and digital wallets are the most obvious developments here, and it has spawned a whole range of copycat services, and generally opened people’s eyes to alternative payment methods. Everything is going mobile Mobile comes in many different forms, it can be people shopping from their mobile devices, checking and comparing product details while out and about, it can be paying from a digital wallet (for example, settling the bill in a restaurant), in-app or social media payments, or can be mobile POS, taking the till in the form of a tablet or smartphone to the customer for customer assisted selling. If consumers pay using their mobile (ApplePay, GooglePay, SamsungPay etc), the limit is much higher than £30, although few realise this. As the innovation continues, contactless payments are now evolving thanks to NFC enabled smartphones and the digitizing of cards. Physical contactless cards are no longer needed. This is significant for a few reasons for retailers. If consumers pay using their mobile (ApplePay, AndroidPay, SamsungPay etc), the limit is much higher than £30, although few realise this. The customer has the mobile phone which provides additional authentication via fingerprint or other verification/ biometric method, so the risk to the card issuer is much lower. As this becomes more commonly known, so transactions values and volumes are likely to increase even further. Another important benefit of mobile digital payments is the ability to collect customer data, for marketing use, and to send online receipts. This enables retailers to build a relationship with the customer after they have left the store or made their online purchase. Digital payments needs to sit alongside loyalty and reward programmes in order to drive customer acquisition and retention. Prepaid and gift cards are also an alternative to cash that continue to gain in popularity. These are used online as well as in-store and are available in digital format as well as plastic cards. There will always be some element of cash While the complete demise of cash has been predicted in some quarters for years, there are several reasons why we should hope that it doesn’t happen. Not everyone has access to a credit or debit card, or the internet, so a card only policy means that these potential customers are excluded. Some people will always want to pay with cash. Consumers come in lots of different groupings, with age being an important factor in their choice of how to pay. There is also another reason that we should keep cash alive. If there were no hard cash alternative for payments, it would be very easy for fees to be increased because there would be no competition. A few years ago there was a public outcry when the banks announced that they were going to phase out cheques. While cheques are hardly ever seen in stores, they do provide a useful method of payment in some instances, for example, for charities, for the elderly or when sending payment by post. Now it is all about providing choice to the consumer, so cash is unlikely to be phased out any time soon. And as for cryptocurrencies like Bitcoin – another South Sea Bubble or Tulipmania! At the moment, this is a technology looking for a problem to solve, and so far, it hasn’t found one in the legitimate, non-money laundering world! Digital payments – The Pros & Cons The benefits of going cashless can be summarised as follows: Less chance of fraud and robbery, as no cash held on the premise No cash handling fees from the bank, and no trips to the bank to pay it in Quicker transactions, better for the retailer and the customer, shorter queues Better marketing opportunities by collecting customer data for future use The average spend tends to increase when cards or contactless are used Required for e- and m-commerce The drawbacks of banning cash: Excluding potential customers that would like to pay with cash If cash is withdrawn altogether, processing fees are likely to increase Less privacy for the consumer In summary, there are many more

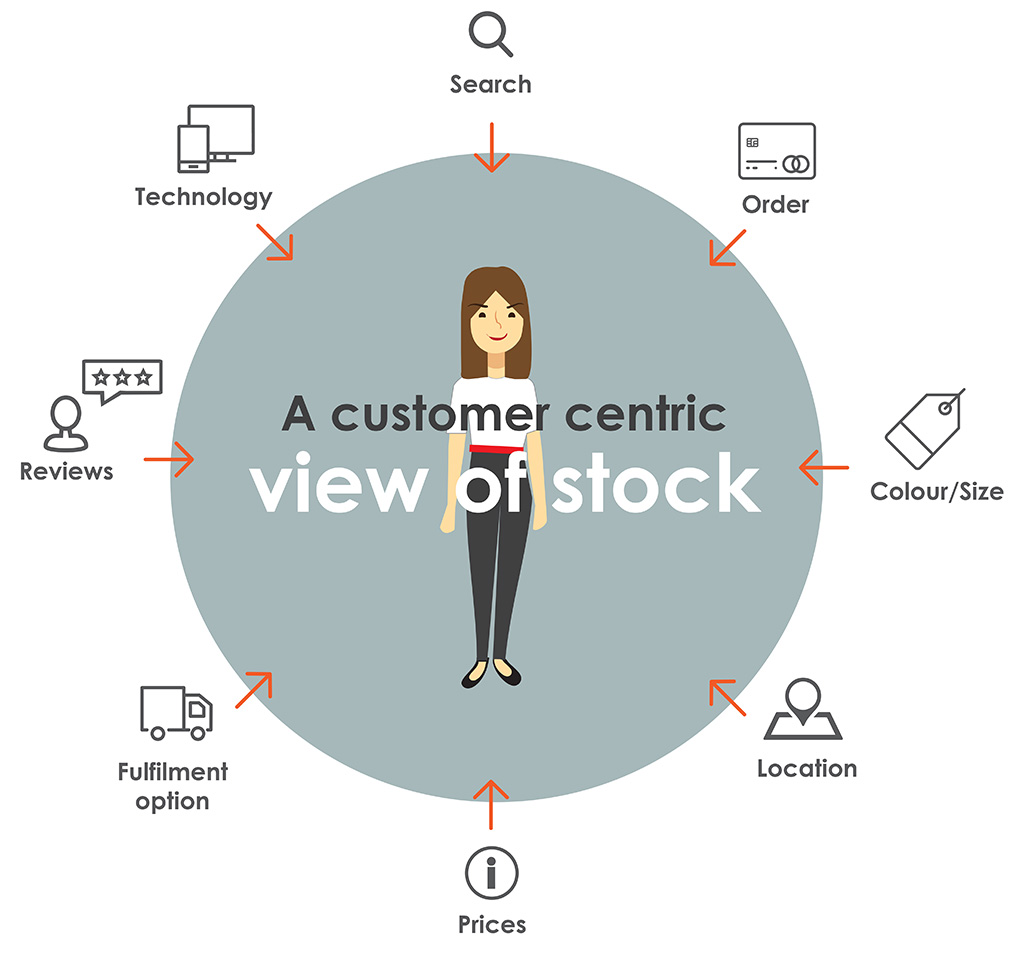

Customer centric stock and delighting your customers

Retailers face a variety of challenges – not least successfully streamlining the customer journey across the many sales channels available and maintaining customer centric stock. Richard Loh, CEO of Eurostop, discusses how technology can help retailers to facilitate this journey and delight the customer, however they choose to buy. Today’s retail market is a complex one, selling through multiple channels to customers who have more choices than ever, and arguably, no longer show strong brand loyalty. Price sensitive, they can shop online for the cheapest deal and have it delivered within hours of ordering. It is undeniably a customer centric world. For the fashion retail market there are even greater challenges, for behind the customer expectation of immediate availability, there lies the very real possibility of disappointment in not having their choice available in stock. The fashion and footwear business is a tricky beast to manage, with size, colour, material and fit, adding to the complexity. For the retailer, delighting the customer means that stock must right across all of these elements to achieve the sale. It means ensuring customer centric stock and that the right stock is available at any outlet where the customer chooses to buy – whether at a retailer’s franchise, pop-up, concession, own store or online. The successful retailer will be the one that can consistently meet customer demand, quickly and efficiently – no mean feat. Smoothing the customer journey A customer may visit a store only to be disappointed by finding their size is not in stock. The winning retailer in this scenario will be the one that can check quickly on its systems if and where it has the correct stock to fulfil the order. Of course, many retailers may invest in safety or buffer stock, particularly on best sellers, in an effort to avoid this customer disappointment. But this buffer stock comes at a price – not only does it take up valuable storage space, it relies on many different factors to ensure it is profitable. The commercial threshold for keeping such stock often depends on timing – matching seasonal trends and confidence in the sales to ensure that new lines sell at optimum price, that there is no overstocking or need to discount at a possible loss. Unsold safety stock that ends up being sent to an outlet to be discounted may prove to be a costly way to guarantee customer satisfaction. Optimising stock across channels Avoiding this situation relies upon having an accurate, single view of customer centric stock across the business. From the distribution centre, across all stores (including concessions and franchises), an accurate view of stock styles, sizes and colours, enables a retailer to deliver true customer satisfaction. Many retailers claim that demand is mostly created in store with online used more for research, which means that failure to fulfil in store requests is missing a huge sales opportunity. Consider again the example of a customer entering a store to try on a particular item and then wanting to try a smaller size or different colour. The retailer with a connected, single view of customer centric stock can quickly check stock levels across the business. They may then offer the customer a home delivery, which may be fulfilled from another store or the warehouse. The only difference may be the way that the item is packaged. Although for some business models it can be more profitable to fulfil from a distribution centre rather than a store, it may be that ‘delighting the customer’ comes at a higher, but necessary cost to secure the sale. Plus any increased sell-through can ensure that seasonal stock does not linger, freeing up space for new lines. It is, as they say, a ‘trade-off’ and one that a real-time view of stock can help to balance. This connected view of stock also benefits staff. Providing them with the tools to do their job – a tablet or smartphone that enables them to check stock instantly on the shop floor without leaving the customer – dramatically increases the chance of a sale. They need no longer check stock in the back room, leaving the customer unattended. Customer centric model, not stock centric The tech-savvy retailer will already have invested in connected systems to provide a real-time single view of stock across the business. But it is important to ensure that this business model uses customer centric stock, and is not simply stock centric. Intelligently using stock data to meet customer expectations What this means is intelligently using stock data to meet customer expectations. Checking popular sizes and colours that are selling fast, at which location, and auto-replenishing will help to avoid the need to arrange special customer fulfilment requests. A real time view provides up to the minute sales information that can be acted upon quickly. Tracking customer purchases and preferences is, of course, also a natural next step in ensuring customer loyalty and patronage. As important is tracking returns of items and the reasons. Analysis may show that certain pieces or lines have a poor fit, or the material quality is not as expected, all important feedback for the buyers and merchandisers. Retail technology that makes a difference Technology today offers many different options to manage stock. RFID has come a long way since the early days when it was introduced. It takes all the hard work out of inventory management and can track exactly what stock is in the store, dramatically reducing dependency on safety stock. This accuracy helps to ensure that stock is in the right place to deliver real customer satisfaction. Other new technologies are emerging, such as video analytics, where observing how customers interact with products can help to identify how and why items are selling. For example, merchandisers may have put a new clothing line in a key position in store which attracts customers on entry. If customers pick up the item, then the price is right, if they then take it to the fitting room, then the

Eurostop is listed in Insights Success ‘The 10 Best Performing Software Solution Providers 2017’

Eurostop is featured in Insights Success, December 2017 edition: The 10 Best Performing Software Solution Providers 2017 We were very pleased to be featured in Insights Success, with a story on Empowering Retailers with EPOS and Stock Control Software Read about my thoughts on: the retail industry tackling internationalisation and the future with Award winning EPOS and Stock Control software One EPOS solution connected across your business and retail channels for a connected customer centric experience Read the full article in Insights Success

Eurostop’s Tenant Management System as advertised in Retail Week (November 2017)

Richard Loh, CEO and Founder of Eurostop, talks about the product that has already had major traction in Asia; now being released in the UK and Europe. As advertised in the November issue of Retail Week Property Supplement. Eurostop’s Tenant Management System now available in the UK & Europe New turnover based rental model is designed to keep shopping centre space leased 2 months free trial available (available in the UK & Europe, terms and conditions apply) Our Tenant Management System, e-mall, is already in use by leading shopping mall operators in Asia such as SingPost, Tanjong Pagar, Frasers Centrepoint Malls and Gardens by the Bay. I’m pleased to let you know that it is also now available in the UK, offering a new way to manage your retail tenants and F&B tenants. It will allow you to optimise the way in which you lease your retail space. I think it’s a great time for shopping centre owners, or any owners of retail or F&B leased space to consider this model. With new digital channels, the physical space has still proven to be an equally important part of a brand experience, however economic uncertainty along with the changing retail landscape mean that landlords must also adapt to maintain footfall and lease occupancy. We have seen that retailers can struggle to keep up with the high annual rental lease options offered by shopping centres in the UK. It leaves them with limited cashflow and can mean that they have to reduce their physical footprint. This can leave landlords with empty space, which isn’t good for the shopping centre. Using a rental plus commission/turnover model, shopping centre owners can offer a more flexible partnership, so that their retailers can have more fluidity with day to day cashflow. I also encourage landlords using our Tenant Management System to take advantage of the live and on the go reporting available in our system. Being able to react to seasonal, daily and even hourly fluctuations, and retailer promotions means that they can use these valuable insights to see what is working and drive further footfall. I can also let you know that we are soon to release further reporting for tenants that will help the retailers to strategise as well. If a retailer is doing better, then ultimately, this benefits the shopping centre and keeps the space filled. Free 2 month trialWe are offering a free 2 month trial of the system in the UK and Europe. If you are interested or want to talk about the free trial, please get in contact with a member of my team.

Missguided EPOS Rollout in New Bluewater Store & Other News

It’s been an eventful month in the news, and also at Eurostop. We have lots happening here in the UK, so I wanted to share a few updates with you. EPOS Rollout at New Missguided store in Bluewater Images sourced from Dalziel & Pow Everyone in the office was looking forward to having a look inside the new Missguided store at Bluewater. This is the second bricks and mortar store for the retailer and we are certainly excited to be part of their journey onto the high street. A big congratulations to Nitin Passi and his team who opened their new store earlier this month. New Partnership between Eurostop and Global Blue Tax Free Shopping Global Blue is a market leading tax refund operator, helping retailers to sell more and grow their business. I have signed a new partnership agreement, so that we will be integrating our EPOS software, e-pos touch, with Global Blue. This will allow our retailers to have the option of offering their international customers an attractive price reduction by providing them with the documentation to reclaim the VAT after they export their goods. The EPOS integration will allow retailers to issue a Tax Free Form from their EPOS terminal quickly and efficiently. This feature is expected to be available in e-pos touch in September 2017. Diebold Nixdorf Partner Summit Europe 2017 Dinesh Peerez and Phillip Moylan represented us at the Partner Summit Europe 2017 in Madrid. Thanks to our hosts Diebold Nixdorf for a great event and to Nicolas Segons for inviting us. Diebold Nixdorf is our chosen EPOS hardware supplier. It was very interesting to hear about their vision for Connected commerce and the Future of Retail. Dinesh and Phillip briefed me on their key takeaways from the conference. I’m sure that these will feature in some of our future posts, so be sure to look out for them. AI is going to disrupt the retail environment A cashless society is here to stay Retail changes are being driven by customer experiences Go live of e-fulfilment with e-pos touch at JulesB JulesB were our first customer to receive our new Fulfilment module with out latest EPOS software. Thanks to Tom Jeffreys and his team for their input during the rollout. I wish them continued success with the business.

Planning for Brexit – are you ready?

Richard Loh, CEO and founder of Eurostop, talks retail and planning for Brexit Retail is the bellwether for the state of the economy. If there’s a slow down the retail sector feels it first. Britain is used to dealing with difficult trading conditions, so how is Brexit any different? The biggest issue facing the retailer in my view is the strength of sterling in the current economic climate. Fluctuating exchange rates mean that retailers may need to reconsider how they source their goods and services. Dealing with Eroding Margins Exchange rates are expected to remain volatile, due to the uncertainty of Brexit. Sterling has already weakened, making purchases from overseas more expensive. These extra costs must either be absorbed, lowering margins, or passed onto the consumer. Most retailers will probably end up doing a bit of both. As we all know, when margins are eroded, that increases the pressure to sell more. This is where brand awareness and customer loyalty comes into play – retailers that have a strategy for increasing engagement and keeping customers coming back are the ones that are going to remain or even gain market share. On the flip side of the coin, early 2017 realised the predicted Brexit tourism boom, which has seen increased spending from overseas tourists in the UK. This is an area that you can’t afford to ignore. Of course, sourcing from the UK is also worth considering, which has the added benefit of reducing lead times and supporting the UK economy. Customer Experience is King Even in the aftermath of the post Brexit vote and falling pound, British retailers were whipped into a storm of price reductions and competition, in an effort to win customers. Savvy consumers are driving retailers to change. Those retailers with the insight to look at re-imagining their business strategies and adjusting to changing consumer behaviour will remain in the long term. Consumers aren’t just interested by the product you have to offer, but just if not more important, is the service and experience that you can provide. This is where retailers need to use technology to ensure a quick and consistent service to complement their product and brand, and stand out from the competition. Digital disruption, Artificial Intelligence, the Internet of Things and Big Data are all emergent technologies that will see the future of retail change with an ever more customer-centric and personalised approach. I guess the message here, is that in a more competitive Brexit era, we all have to work a little harder to stay ahead of the game. It’s the consumers who are dictating which court we need to play in. 52% of B2C customers stopped buying after a bad customer service interaction* Market Rationalisation Opportunities As ever when we are facing a storm, some retailers will flounder and others will sail through, all the stronger. For those that are supported by enabling technology, there will be opportunities to acquire more market share, either by acquisition of competitors, or by expanding to fill gaps left as competitors leave the market. Currency exchange rates may yet move back the other way, restoring margins and putting retailers in a better position. Here are my top tips for making a success of Brexit Five top tips for weathering the Brexit storm Start planning now. We all know it is coming. Start looking at your supply chain, negotiate with suppliers, wholesalers and manufacturers to get the best terms possible. Find alternative suppliers if you need to. Put your business on a solid footing. Take a fresh look at your operations. Trim the fat where you can, re-organise where you need to, and ensure that you have the technology to support a more efficient and competitive approach going forward. Look to improve your Customer Experience. Is your brand consistent and connected across all channels? Time, convenience and excellent customer service are now key differentiators for customers – can they get what they want, how they want and with least fuss? Build Customer Loyalty. Think about what you can do differently to build loyalty? Knowledge is power, so start by ensuring that you are collecting customer data, to use for more personalised marketing – show your customers that you care, and focus on building relationships. Keep them happy as they are your most powerful brand ambassadors. Make the most of your capital. In this challenging time, you need the right technology to make the most of your available stock. Have the right stock, at the right time, in the right location – are you making the most of every potential sale opportunity? You need transparent systems that are going to give you the information that you need quickly and with the least amount of work. *According to a report by Dimensional Research

What every retailer needs to know when going international

Four key steps when looking to expand overseas – Richard Loh, CEO and Founder of Eurostop Ltd. offers his thoughts and tips on expansion overseas As a successful retailer operating your business in the UK you may well now be considering expanding overseas. We have worked with many retailers over the years who have done just this and I can now say with pleasure, have growing international store networks. You have probably already done your market research, developed your business plan and identified locations for your new stores. However, working with our clients on exactly these opportunities we have encountered a few things that are worth thinking about before embarking on your new journey abroad. Download the whitepaper to find out Richard’s tips for international expansion. The whitepaper covers 1. Understanding the culture 2. Getting up to date on local legislation and taxation 3. Working out the IT 4. Going that extra mile Download white paper Please fill out your details below. You will then be redirected to download our FREE PDF. [email-download download_id=”7937″ contact_form_id=”7936″]